Oct 27, 2016 | News

Insurance fraud continues to be a major issue. It impacts every insurance company and virtually every customer as insurers increase premiums to offset fraud losses. The general consensus is that suspicious activity is increasing and the tactics used by fraudsters are more sophisticated.

So what constitutes insurance fraud? Insurance fraud happens when an individual or a group of persons deceives an insurance provider to get some money. They do this with full knowledge of the act and can be very resourceful when fabricating or exaggerating a claim.

Because insurance fraud can occur in so many different ways and may involve a wide range of participants, protecting yourself from it needs more than just common sense. You’d have to know the tell-tale signs of insurance scam so that you can proactively avoid falling for it.

Intro to Insurance Fraud Online Course

Trick No. 1: They follow global market trends.

Like any smart businessmen, insurance fraudsters are always alert to trends. Are the nouveau riche in China thirsting for luxury cars? No problem; organized fraud rings have built a veritable pipeline to the Asian black market.

Trick No. 2: They take advantage of the vulnerable.

Whether it’s disaster-stricken homeowners desperate to put their world right again or immigrants unclear on the ways of insurance, fraudsters prey on the vulnerable. Scammers also love to take advantage of people who’ve been hit with a natural disaster. Unlicensed and incompetent contractors descend on catastrophe-devastated areas and lure traumatized homeowners into signing contracts.

Trick No. 3: They make it happen on paper.

Emulating white-collar criminals, many staged-accident fraud rings bypass the dangers of “real” fake accidents altogether and instead make everything happen on paper, with fake passengers, fake injuries and fake treatment. Simply inventing medical treatment records of imaginary crashes increases the crook’s control and lessens the likelihood of being busted.

Statement Taking & Investigations Online Course

Emerging Insurance Fraud Trends

Fraudsters are highly adaptive and continually change tactics, strategies and even modes of operation.

In past years, most schemes seemed focused on false auto thefts and property arsons. Fraud schemes today have shifted much more to bodily injuries and suspicious activities by medical providers. Workers compensation and auto insurance most notably have seen these changes in tactics. In response, insurers increasingly are adopting advanced analytics to counter the changing nature of fraudulent activity.

One growing challenge is rising point-of-sale or underwriting fraud to illicitly reduce premiums.

Fraudsters can test system thresholds by filing many different applications online and manipulating rates by changing rating factors to reduce premium. In addition, analysis suggests that a significant amount of claims fraud is perpetrated through illegally obtained policies. By shifting from a reactive to a more-proactive posture, insurers are reducing fraud at policy inception, and are denying rate evaders a chance to file false claims once the ill-gotten policy is in force.

Cyber fraud is another emerging threat insurers are facing. Insurers collect a large amount of personal information that identity thieves aggressively seek. The number of companies reporting attacks has increased significantly since 2012. Yet, only 14 percent of insurers now employ technology to prevent cyber fraud, according to the current survey. That number is expected to significantly rise in the next few years

Cyber Risks For Insurance Professionals Online Course

SOURCE: http://www.insurancefraud.org

SOURCE: http://www.sas.com

Sep 27, 2016 | News

INSURANCE CONTRACT BASICS

People enter into insurance contracts for the protection these contracts provide. Contracts can be made orally or in writing. To eliminate disputes as to whether a contract existed, it is recommended that contracts having significant or long term obligations be made in writing.

Parties to the Contract: There are at least two parties to every contract regardless of its purpose. In property insurance contracts, these parties include:

– the insurer, and

– the insured.

EXAMPLE: Last week, Alex and Olivia Gregory completed an application for insurance for their home. The application was sent to the XYZ Insurance Company. They received their insurance policy yesterday. Both the Gregorys and the insurance company are considered to be parties to the contract.

The party that drafted the contract is generally considered to be the “first” party. In this case, that would be the XYZ Insurance Company. The other party, the Gregorys, is considered to be the “second” party.

There are people who are not considered to be a party to the contract but who are entitled to make a claim against it. These people are known as third party claimants. Liability insurance policies are an example of insurance contracts that provide for payment of claims directly to third parties.

Five Essential Elements Required of All Contracts

A contract is a legal agreement between two or more parties that is enforceable at law. There is not much sense having a contract if it is not enforceable at law. In order for a contract, regardless of its purpose, to be legal and, hence, binding on all parties, it must contain five essential elements, including:

(1) AGREEMENT

For agreement to exist there must have been a meeting of the minds between the parties as to:

– the subject matter of the contract, and

– its terms and conditions.

The term “meeting of the minds” is a legal term indicating that the parties know what the substance and terms of the contract are and that neither party has withheld information that should be known by the other party.

A definite offer must be communicated by one party to the other.

EXAMPLE: John Mandin saw a used ATV for sale in the newspaper. He called the owner saying that he liked it and that he might offer him the asking price when he came to see it later that day. The owner told him that he could come by any time. Later that day, the owner sold the ATV to another person. John was furious. He insisted that he had made an offer equal to the asking price and that the owner had led him to believe it was his for that price. In this case, a definite offer was not made. John indicated that he “might” buy the ATV for the asking price subject to the condition that he sees it first.

That offer must be unconditionally accepted by the other party.

EXAMPLE: i) A person looking to buy a home offers the seller $5,000 less than the listed price. The seller then advises the party making the offer that they will drop their asking price by $2,500.

ii) The applicant for insurance requested a policy with a $500 deductible. Today, the insurance company advised the applicant that the minimum deductible it was prepared accept for the property being insured was $1,000.

In these instances, there is no agreement. Instead, the seller of the home and the insurance company have made what is known as a counter-offer. A counter-offer makes the original offer invalid. If the person making the original offer decides not to accept the counter-offer, the process is over. However, if he or she still wants to establish a contract, the negotiating may begin all over again.

So long as this negotiation process is continuing, there is no agreement. Agreement exists only when one party unconditionally accepts the offer of the other party.

Once accepted, the offer cannot be withdrawn. However, once an insurance contract has been issued, it can be cancelled in accordance with the termination provisions included in it.

EXAMPLE: Last Monday morning, the insurance company underwriter informed the broker that the company would provide Mike’s Auto Body Inc. with a contract of insurance. However, that same afternoon the underwriter called the broker to tell her that he had thought about it some more and that he has made the decision to withdraw his acceptance of the offer made by the owner in his insurance application. According to contract law, the underwriter cannot do that. However, after the policy has been issued, the insurance company can exercise its right to cancel the policy by providing Mike’s Auto Body Inc. with proper notification as described in the that contract.

The offer and acceptance do not need to be in writing. In law, an oral agreement is as binding on the parties as is a written agreement.

The best way to avoid misunderstandings about the terms of the contract is to ensure that the offer and acceptance are provided in writing.

In the business of insurance, the application for insurance constitutes an offer. The issuing of the policy as applied for constitutes acceptance of that offer by the insurance company

When the application for insurance is in writing, the policy must be issued exactly as applied for. If the insurance company decides to make any changes, it must advise the applicant in writing of those changes.

The insured doesn’t have to accept the policy. if they don’t want to. In contract law, a person has up to two weeks (no time limit in Quebec) to reject the contract after receiving notification of the changes. If the insured does not do that, he or she is considered to have agreed to the changes.

If the insurance company does not provide the insured with written notification pointing out the difference between the insurance asked for on the application and the insurance that was actually provided on the policy, the insured may have a right to the coverage as applied for.

EXAMPLE: The insurance company issued the Olsen’s homeowner’s policy without the sewer back-up coverage requested by them on their application. The insurance company did not provide the Olsens with written notification of this reduction in coverage. Three weeks after having received the policy, the Olsens had a $30,000 sewer back-up loss. In this situation, the insurance company would in all likelihood be ordered to pay that claim. However, if the loss occurred six months after the Olsens had received the policy, the insurance company may well argue that they had sufficient time to notice the reduction in coverage and that they agreed to the change.

Normally, these kinds of oversights will not occur. This is because brokers and brokerage staff review all new policies to ensure they have been issued in accordance with the application. That is standard operating procedure in all brokerages.

(2) Legal Capacity to Contract

All individuals wishing to enter into a contract must be recognized at law as being entitled to do so. This generally includes all persons over 18 years of age. These persons are seen in law as having the legal capacity to contract with others.

Note: In Saskatchewan, a person who has attained the age of 16 years is considered to have the capacity of a person of 18 years to make an enforceable contract of insurance.

[Section 64, Insurance Act]

i) Minors are persons who are considered to be under the age of legal competence. That means they do not have the right to enter into a legal contract. In most provinces, minors include all persons less than 18 years of age.

This limitation helps to prevent the exploitation of people who often do not have the experience or sophistication required to properly protect themselves in business matters.

(ii) However, minors do have the restricted right to enter into contracts for the necessities of life such as food, clothing and lodging or other contracts made for their benefit.

This information is an excerpt from CHAPTER 2 of the ILS Level 1 General and Adjuster Insurance Licensing Program (L1). ILS L1 program is the most up to date provincial level 1 insurance licensing program available and contains everything you need in one package to successfully pass your level 1 insurance licensing provincial exam.

To start your career in insurance click here.

Sep 20, 2016 | News

View the video demo of the ILS Level 1 General Insurance Licensing Program and test your knowledge by taking the quiz.

The ILS Level 1 Licensing program has everything you need in one package to successfully pass your Level 1 General Insurance Licensing exam.

Still not sure if this program is the right choice for you?

View the CHAPTER 1 Video Demo and see what taking an online course is all about.

VIDEO DEMO ILS L1

The video demo is a sample of Chapter 1 of the L1 program – INTRODUCTION TO GENERAL INSURANCE

CHAPTER ONE CONTENT SAMPLE – Insurance is all about risk sharing. It’s not a new idea having been around for thousands of years. Risk sharing is a way of helping to ensure that a loss does not spell financial ruin for a person or business. It involves coming up with ways to accomplish that. Before the days of insurance companies, people came up with ways the community would share individual risks.

EXAMPLE 1: Back in the days of the caveman, when a hunter was killed in the hunt, his widow and family were supported by the other hunters.

EXAMPLE 2: The Yangtze River in China is a treacherous waterway and early traders travelling the river had their work cut out for them. Rather than take their entire trading goods over the many rapids on their own, they would meet at a sheltered area of the river and place a portion of their cargo in each of the many boats gathered there. This way, if one boat failed to negotiate the rapids safely, every boat owner still had some of their goods in the other boats. No one faced the prospect of losing everything and having to start their business over again. That’s what insurance does – it’s all about risk sharing.

Today, insurance companies take money from thousands of people and, for all practical purposes, keep that money in a pool from which to pay losses. The basic concept hasn’t changed – each contributor’s money is used to pay the losses of the few in their group who will have them. Basically, insurance is a mechanism for sharing the losses of the few among the many.

RISK AND RISK MANAGEMENT OPTIONS

Point 1: Definition of Risk: “Risk is the chance of financial loss as a result of loss or damage to the object of insurance or some other happening.” As individuals, we don’t know whether we will have a loss or not but we know that we will be worse off financially if we do. Everyone is exposed to risk in daily life, including:

Personal risk – the risk of dying, becoming seriously ill, disabled, or unemployed.

Property risk – the risk of loss or damage to property owned, rented or leased.

Liability risk – the risk of being held financially responsible for bodily injury or property damage caused to others.

People or organizations that have these kinds of risk face the potential for financial loss.

Point 2: There are two kinds of risk:

Speculative Risk: provides people with the chance to either make a profit or a loss.

Insurance is not intended for speculative risks. There is no insurance company willing to provide insurance for bankruptcy or loss of money from gambling.

EXAMPLE: Making the decision to go into business is a speculative risk. You either are successful or, as a worst-case scenario, you go bankrupt. Gambling is another example of a speculative risk. At the end of the day, you have either won money or lost money.

Pure Risk: provides only the potential for financial loss with no chance of gain or profit.

Insurance is provided for pure risks only. In other words, insurance can be purchased only for risks that have the potential for financial loss and no chance of financial gain. As we have seen, the purpose of insurance is to attempt to put the insured person back in the same position he or she was in immediately prior to the loss.

EXAMPLE : Owners of property will suffer financial loss when their property is lost or damaged. If there is no loss to their property, they do not gain or profit – their situation remains unchanged. Business owners can also be sued when their negligence causes bodily injury to another person or results in damage to that person’s property. If they are fortunate enough to carry on their business without being sued, they do not profit from that – their situation remains unchanged. There is no chance of profit or financial gain in these situations. Pure risk provides the chance only for financial loss.

CHAPTER 1

INTRODUCTION TO GENERAL INSURANCE

1. Insurance – The Basic Idea: Risk Sharing.

2. Risk and Risk Management Options

3. Definition of Insurance

4. Functions of Insurance

5. Types of Insurance Companies – Legal Form

6. Internal Organization of Insurance Companies

7. How Insurance is Distributed

This is just a quick sample of the ILS Level 1 General Insurance Licensing Program, to learn more about the program click here.

Sep 13, 2016 | News

If you’re thinking about starting a career in the insurance industry by completing your level 1 licensing courses online, you may be nervous and worried that the online learning environment will lack the “human touch” your used to in lectures and seminars.

However, online learning has come a long way over the last few years and it’s probably not what you imagine – instructors don’t just toss all the regular course materials online and leave it at that.

ILScorp has a a whole department dedicated to making online learning not only educational but also dynamic, engaging and interactive. We also have live customer service representatives available to you via email, live chat and telephone for any questions or assistance you may need along the way.

VIEW VIDEO DEMO OF LEVEL 1 LICENSING COURSE

Why should you consider taking classes online versus in a classroom?

The option to learn from anywhere, anytime – even while being in the comfort of pajamas – speaks for itself! The instructional planning and careful design of online courses takes into consideration the various learning styles and characteristics of online learners. Taking an online course creates an opportunity for those who value work-life balance, are self-directed and motivated, and are at varying stages in their professional development to improve their skills and meet their mandatory requirements faster.

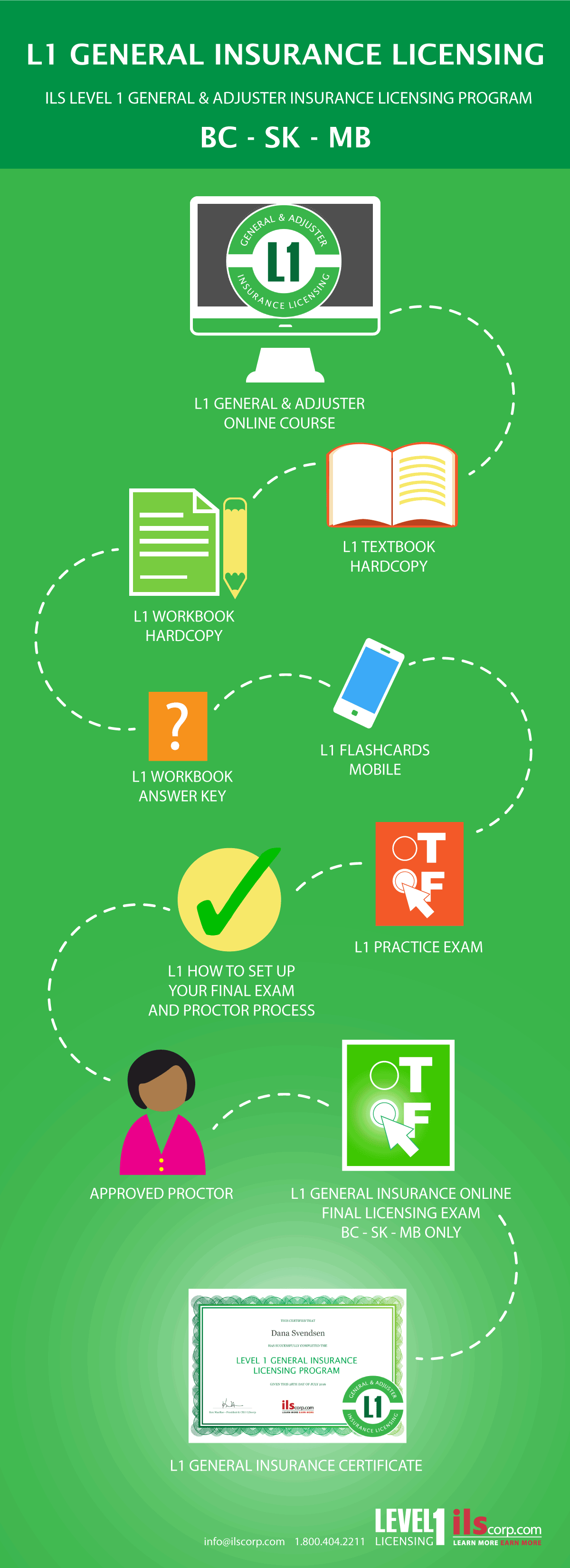

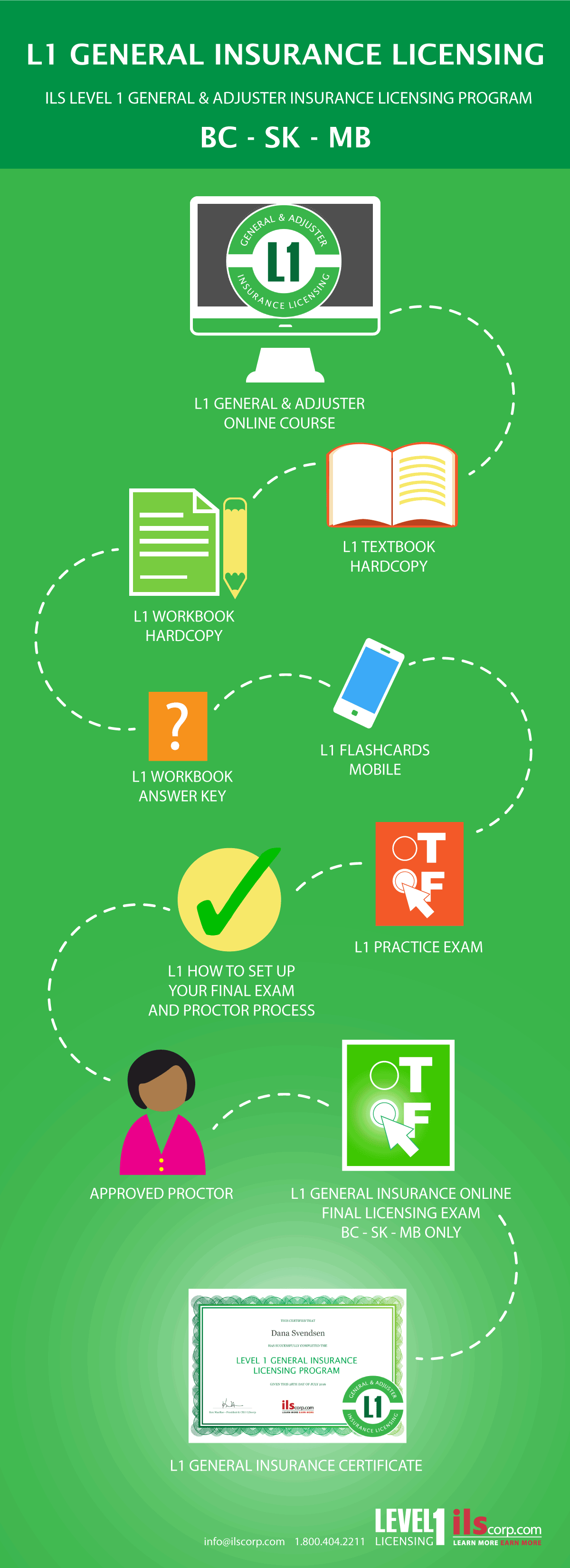

The ILS Level 1 General Insurance Licensing Exam Preparation Program

The foundation of your ILS L1 Program is the online video course, hardcopy textbook, and workbook, each organized into easy to manage chapters. Utilizing all three learning elements enables you to listen to the content as it is narrated in the video course, follow along in your textbook, and enforce your knowledge retention by answering questions on key concepts in your workbook. With the ILS L1 Program all forms and coverages are current, key concepts are expressed using real life scenarios and examples, end of chapter quizzes can be taken as many times as you wish, and the workbook has over 650 exam type true or false questions along with answer keys.

The ILS L1 Program has everything you need in one package to successfully pass your Level 1 General Insurance Licensing exam. Start your career in insurance today.

MORE INFO ON L1 COURSE

Sep 6, 2016 | News

But why would you want to work in insurance?

Looking for a solid career that won’t require a multi-year college degree?

The insurance industry may be just the right place for you.

People may not think of insurance as the most glamorous industry in Canada, but it does offer stability, challenge and growth to those who choose the profession.

It’s an incredibly diverse and gratifying career choice, with huge scope for personal fulfillment, network building, professional development and of course financial reward. A career in insurance will take you as far as you want to go.

Insurance is already a huge part of everyday modern life, so why not find your career in it!

Become a Level 1 General Insurance Sales Agent without spending thousands of dollars or committing to years of schooling with ILScorp’s new Level 1 General Insurance Licensing Program.

With just 80 to 120 hours of self -study time, you can obtain your Level 1 License and begin your new career in the insurance industry.

Level 1 Licensing Program

ILS L1 Program has all the learning material you need in one package.

The ILS L1 Program includes an online video course, hardcopy textbook, and workbook; each organized into easy to manage chapters. Utilizing all three learning elements enable you to listen to the content as it is narrated in the video course, follow along in the textbook, and enforce your knowledge retention by answering questions on key concepts in the workbook. At the start of each chapter in the online video course you will be introduced to the main topic and learning points and told the desired outcomes.

Cut through the jargon – Understand Insurance

Key concepts are expressed using real life scenarios and examples; you won’t need a translator or dictionary to learn the material.

Test yourself – again, and again and again….

End of chapter quizzes can be taken as many times as you wish and you can test yourself on the go with the L1 mobile flashcards with over 100 exam type questions. The L1 workbook has 650 questions along with answer keys plus the practice final exam will set you up to experience the actual online licensing exam scenario.

Your online Level 1 General Insurance Licensing Exam – yes it’s actually included!

As you may be in shock we’ll say it again. Your online Level 1 General Insurance Licensing Exam comes with your L1 Program. It’s included in the cost of the program and completed entirely online. Once you successfully pass the L1 Final Exam you’ve done it! Congratulations! You can now apply to your provincial insurance council to receive your Level 1 General Insurance License.

To learn more about the ILS Level 1 General Insurance Licensing Final Exam CLICK HERE

Level 1 Final Licensing Exam available for residents in BC, SK and MB.

Aug 30, 2016 | News

Your CE is fast, easy and done all at one low cost with the ILScorp General Insurance CE Course Subscription.

The ILS General CE Course Subscription contains over 185 provincially accredited courses including 21 courses that are RIBO accredited in the Management Category.

RIBO accredited courses in the Personal Skills and Technical Category are also part of the ILS General CE Course Subscription.

GET RIBO CE

With ILS General CE Course Subscription you will:

- have access to over 185 accredited general insurance training courses in both text and streaming video formats, including personal lines, commercial lines, auto, farm, professional management and personal skills courses

- save money compared to purchasing individual courses

- have a digital record of your CE and completed course work, which we keep on file for up to seven years

- save time by completing your general insurance continuing education requirements entirely online, no paperwork or commute

- print your CE certificates immediately or as needed

- have unlimited course access for 6 months

Advantages of your CE Course Subscription:

- Once you purchase your subscription, you can begin taking your courses immediately! If you are a new subscriber, you will receive an automated username and password by email.

- Courses can be accessed any time and you can log in and log out as many times as you wish during the course period

- Quizzes and Final exams are offered in our courses to help you retain the information

- All quizzes and Final exams can be taken as many times as you wish

- Should you require any assistance at any time during your course work, we are here to support you 5 days a week, 0800 – 1700 PST

View courses in this General Insurance CE Subscription